Why Now Might Be the Best Window for New Construction in DFW

Hey — I'm Zak Schmidt. If you're thinking about buying new construction home in DFW, this post is for you. I recently walked through the numbers and trends I’m seeing on the ground across Collin, Rockwall, Hunt counties and several fast-growing cities. In short: builder inventory is up, month-supply is higher than it was, and that opens a real window of opportunity for buyers who move smart. In this article I’ll break down the data, explain what month-supply means, walk you through builder incentives you should expect, and give tactical advice so you can negotiate and win when buying new construction home in DFW.

Table of Contents

- Quick Overview: Where We Are and Why It Matters

- What “months of Supply” Really Means (and How to Use It)

- County- and City-level Snapshot: What the Numbers Show

- What Incentives Look Like Right Now

- Strategic Advice if You’re Buying New Construction Home in DFW

- Where Sellers and Buyers Get Tripped Up

- Important Local Context: DFW Housing Fundamentals

- Practical Checklist for Buyers of New Construction

- Real Examples I’m Seeing Right Now

- Timeline: How Long Might This Window Last?

- Summary: The Decision Framework

- FAQs About Buying New Construction Homes in DFW

- Final Thoughts

Quick overview: Where we are and why it matters

At a high level: the industry metric I’m watching is “months of supply” — specifically, the months of inventory for builder/new construction homes that appear in MLS. When months of supply is low, competition among buyers is high and builders have more pricing power. When months of supply rises, buyers gain negotiability and builders start using incentives to hit unit targets. Right now in many parts of DFW we’re looking at roughly a four-to-six month supply on builder inventory that does show in MLS. That’s a meaningful shift compared to tighter periods earlier.

Important note: the MLS number probably undercounts total builder inventory, because in Texas builders are not required to list every move-in ready home in MLS. Many homes sell directly through sales offices or the builder’s website and never make it to MLS. So what we see on MLS likely understates the real supply. For the purposes of buyer strategy, assume supply is at least what MLS shows and likely a hair higher.

VIEW NEW CONSTRUCTION HOMES IN DFW

What “months of supply” really means (and how to use it)

Months of supply is a simple but powerful measure: it answers this question — how long would it take to sell the current inventory at the current pace of sales? A 3-month supply is a seller’s market. A 6-month supply is typically considered balanced. Above that, buyers have leverage.

- If you’re buying new construction home in DFW, low months-of-supply means fewer incentives and more competition for the homes you want.

- If months-of-supply rises (as we’re seeing), builders begin to use incentives like interest-rate buydowns, closing cost contributions, price reductions, upgrades, and even additional discretionary funds to hit their yearly unit goals.

County- and city-level snapshot: what the numbers show

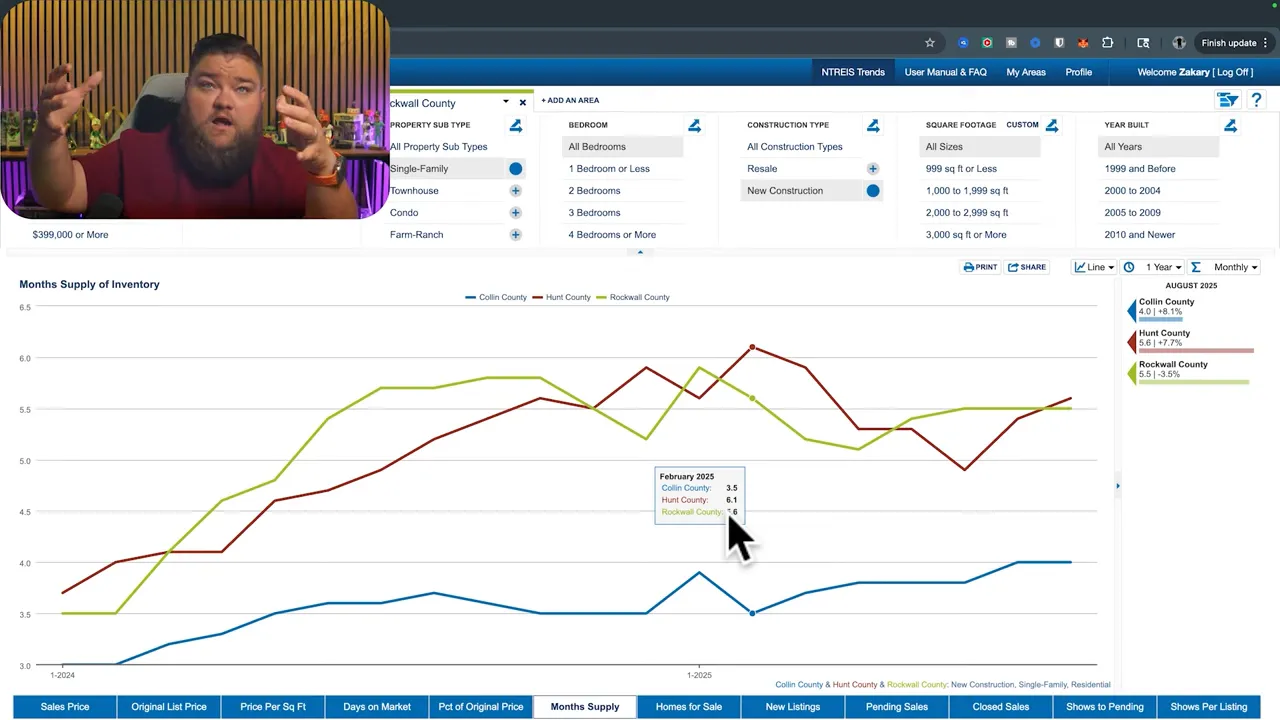

We looked at Collin (northern suburbs like Frisco, Plano, McKinney), Rockwall (Rockwall, Fate, parts of Royse City), and Hunt (areas like Royse City toward Greenville). Here’s what the numbers were showing around late August / September:

- Collin County: roughly a 4-month supply on builder inventory listed in MLS.

- Rockwall County: around a 5.5-month supply.

- Hunt County: roughly 5.5+ months as well.

Digging deeper into cities people ask about:

- Celina: over a 6-month supply of new construction inventory listed in MLS — and that’s only MLS-listed homes.

- Prosper: trending upward — builders are betting on this market and increasing their on-the-ground inventory.

- Melissa: similar upward trend.

- Rockwall (city): currently showing an elevated months-of-supply (about 7 months on a downtrend), Royse City around 5 months, Van Alstyne around 3.8 months.

Why builders are stacking inventory (and why that matters to you)

Big regional builders think in annual unit goals: “We want to sell X homes this year.” As Q3 turns into Q4, builders check their pipeline. If they’re short of their annual target — perhaps because new neighborhoods opened slower than planned or development was delayed — they’ll move to hit those numbers by increasing promotions and incentives. That’s exactly what I’m seeing: price drops, aggressive interest rate buydowns, higher closing cost contributions, and larger upgrade allowances on move-in ready homes that can close by year-end.

One text from a sales rep exemplifies the current dynamic: they had 8–15 inventory homes in a brand-new neighborhood that could close by year-end, and they were dropping prices between $60k and $80k on those move-in ready homes — in a higher-price neighborhood ($600–$800k). They were also offering rate buydowns and closing cost assistance, larger lots and 3–4 car garages on select inventory.

What incentives look like right now

Examples of incentives I’m seeing across DFW builder inventory:

- Interest-rate buydowns that can reduce monthly payments materially (examples like starting effective rates in the high 4% or low 5% territory with a temporary 1-2% buydown).

- Significant closing cost assistance ($10k–$25k in some cases).

- Direct price reductions on move-in-ready inventory (particularly in higher price tiers).

- Upgrades or discretionary funds for options buyers care about (kitchen upgrades, larger lots, three-car garages).

Keep in mind: incentives vary by price point. We’re seeing larger dollar price reductions in the $600k–$800k range. In the $300k–$400k neighborhoods, price drops that large are less common. Instead, those communities might lean more on rate buydowns and closing cost help.

Strategic advice if you’re buying new construction home in DFW

If you’re actively looking, here are the practical, tactical things I would tell you (and often do tell my clients):

- Be ready to move fast. Inventory that’s priced to move will get attention. If you’re prepared with financing pre-approval and flexibility on timing, you’ll have a better shot at the best incentives.

- Understand the trade-offs. Builders aren’t giving away first-born children. When they offer rate buydowns and closing cost help, they may be reducing other discretionary items in the deal (fewer free upgrades, smaller design center allowances, etc.). Know what matters most to you.

- If you have a home to sell, price and market it aggressively. If you need proceeds from a sale to buy, think like a builder — use incentives on the resale side too (buyer-rate buydowns, seller-paid closing help) to make your offer more attractive in a market where builders are carrying contingencies.

- Don’t assume every price drop means the builder mispriced the community. Builders still sell a large percentage of their homes near original list price. That means many are baking incentives into the overall transaction rather than simply slashing sticker price.

Negotiation reality: price vs total net benefit

One point that confuses a lot of buyers: a lower “list price” doesn’t always equal a better net deal. For example, buyer A might get a price drop but fewer closing costs; buyer B might pay a slightly higher list price but receive a $20k closing cost credit and a 1% interest buydown. Net monthly payments and out-of-pocket cash at closing are what matter most. Always evaluate the full package: list price, closing costs, rate buydown, included upgrades, and which concessions are taxable or affect your loan amount.

We have seen builders cut list prices, but when they do, sometimes they reduce included features or discretionary funds (so the buyer actually nets less on upgrades). In other cases, builders have recognized the market and offset price reductions with extra closing-cost help or additional incentives. If you’re under contract and see prices in the model shift, you can always ask to renegotiate — but the odds of snagging both a big price reduction plus the same closing cost package you originally negotiated are relatively small. Expect maybe a 10% chance of that sweet rework in most situations.

Where sellers and buyers get tripped up

Common pitfalls I see:

- Buyers fixating on list price without analyzing effective interest rate and monthly payment after buydowns.

- Buyers expecting builders to accept heavy contingencies when builders are already carrying lots of contingent contracts and tight unit goals.

- Sellers trying to sell a resale without offering competitive incentives — meanwhile builders are enticing buyers with low effective rates and closing help.

- Assuming every builder will react the same — they won’t. Some are more aggressive; some will protect margins and cut fewer extras.

Important local context: DFW housing fundamentals

Remember, DFW remains a growth market. Builders are betting on long-term demand. They’re counting on future rate improvements and continued population growth. The current incentives are, in part, a mechanism to align yearly sales goals with reality when yield and development timelines shift. Yes, we are seeing inventory corrections in places. No, this doesn’t necessarily mean a crash. Instead, it’s a market correction in pockets and a buyer-opportunity window right now.

Even with higher months-of-supply in certain submarkets, overall housing supply in DFW remains tight compared to many other metros. That’s why many builders continue to price competitively and keep a steady flow of new lots coming online — they are planning for growth and positioning for the long term.

Practical checklist for buyers of new construction

Use this checklist if you're serious about buying new construction home in DFW:

- Get a strong lender pre-approval that also understands builder-rate buydowns.

- Decide which incentives matter most: lower monthly payment (rate buydown) vs. lower upfront costs (closing cost credit) vs. upgrades (kitchen, lot, garage upgrades).

- Be ready to act fast on inventory that can close quickly — those are the homes builders are most motivated to move.

- Ask the builder for the net-to-buyer comparison: “If you reduce the price by X, what trade-offs in incentives or features change?”

- If you have a resale to sell: prepare to be aggressive in marketing and consider offering buyer incentives to reduce contingencies and compete with new-build packages.

- Work with an agent who knows builder contracts, how incentives are structured, and how to parse the fine print. That matters a lot.

Real examples I’m seeing right now

Here’s a sampling of real tactics and offers landing in my inbox (actual numbers vary by builder and neighborhood):

- 4.99% effective rates via temporary buydowns on certain move-in ready homes.

- $20k–$25k in closing cost assistance on some models (price tiers and eligibility vary).

- $60k–$80k price reductions on select inventory in higher-end neighborhoods that needed to hit unit counts for year-end closings.

- Upgrade credits or larger lot incentives on moves-in-ready homes to attract buyer interest.

Timeline: How long might this window last?

Great question. I don’t have a crystal ball, and builders won’t keep these aggressive tactics forever because they affect margins and long-term pricing expectations. My read: we’ve been seeing these pricing strategies for roughly 12–13 months in some form. That means the opportunity may be time-limited — particularly for move-in ready homes that can close by the end of the year. Once builders hit their unit goals or the market shifts (rates improve or resale inventory loosens), incentives will likely pull back.

Summary: The decision framework

When thinking about buying new construction home in DFW right now, ask yourself these three questions:

- Do I have the flexibility to move quickly if a great, incentive-backed inventory home becomes available?

- Can I clearly evaluate the total net of a deal (price + closing cost + rate buydown + upgrades) rather than focusing only on list price?

- If I have a resale, am I willing to market it aggressively and use incentives to avoid being stuck in a contingency-laden swap that builders will avoid?

If your answers skew toward “yes,” you’re in a position to play this window well. If your answers are more cautious, there’s no sha

me in waiting; just know others are taking advantage of the incentives now, and time-sensitive inventory will move.

FAQs About Buying New Construction Homes in DFW

What does a 5-month supply mean for me as a buyer?

A 5-month supply generally points toward a market with more buyer leverage than a 3-month market. For buyers, it often means better access to incentives like rate buydowns, closing cost assistance, and upgrade credits — particularly on move-in ready homes. It also means you’ll have more options to compare between neighborhoods and floorplans.

Are builders lowering prices across the board?

Not uniformly. Some builders reduce list prices in higher-end communities to clear specific inventory; many builders instead adjust the overall deal package (rate buydowns, closing cost help, or upgrades). The net effect may be similar in terms of buyer savings, but the mechanics differ. Always compare the full package.

If I'm already under contract, can I renegotiate if prices are dropping?

Possibly — but don’t count on it. Most builders will say price reductions apply to new contracts; they don’t automatically reprice existing deals. You can ask, and occasionally builders will offer to shift the structure (a little extra toward closing cost, for example), but a full redo to match a new lower list price plus previous incentives is rare.

Should I sell my current home before buying new construction?

It depends on your risk tolerance. Builders prefer clean transactions without resale contingencies because they already hold many contingent contracts. If you need funds from a sale to buy, consider marketing your home aggressively and offering incentives to buyers to reduce the chance you’ll be the one delayed at the closing table.

How can I evaluate whether a rate buydown is better than upfront closing cost help?

Run the numbers. A buydown reduces monthly payments, which helps cash flow and qualification. Closing cost assistance reduces cash needed at closing. Compare the present value of monthly savings against the immediate cash benefit and factor in how long you plan to stay in the home. Work with your lender to model the scenarios.

Final thoughts

Buying new construction home in DFW right now isn’t a one-size-fits-all decision. However, the current months-of-supply trends and observed builder incentives create a meaningful opportunity for prepared buyers. If you come in with clear priorities, strong financing, and the ability to act quickly, you can capture upgrades, reduced effective rates, and significant closing help that weren’t as available in tighter markets.

If you want to talk specifics — neighborhood comparisons, a net-to-buyer analysis of a particular builder package, or steps to prepare your resale for market — I’d love to help. Call or text me at 469-707-9077. The right strategy changes by buyer profile, price point, and timing. For those serious about buying new construction home in DFW, now is a time to be informed and ready.

Zak Schmidt

From in-depth property tours and builder reviews to practical how-to guides and community insights, I make navigating the real estate process easy and enjoyable.