Are Builder Incentives Really a Steal or a Scam? A Realtor’s Honest Take on Builder Incentives

Hey—I'm Zak Schmidt, I sell new construction in DFW, and today I want to tear into a topic I get asked about every single day: builder incentives. You’ve seen the banners—“4.99% rate!”, “$20,000 closing help!”, “Pick your perks!”—and you’re wondering if these builder incentives are actually a steal or if they’re hiding something you’ll regret later.

In this long-form breakdown I’ll walk you through how these promotions actually work, why builders are doing them, which ones I like (and which ones I’d run away from), and some real-world payment examples so you can see the math. I’ll talk about the most common types of builder incentives, what the fine print usually hides, and how I structure deals for buyers so they get the most value. Let’s get right into it.

Table of Contents

- Why Builders Are Handing Out Cash (or Low Rates)

- Common Types of Builder Incentives (and How They Work)

- Builder Examples—my Quick Reactions (What I Saw on Their Sites)

- Real Payment Examples and Quick Math

- Fine Print That Matters—what I Always Check

- How I Approach a Buyer Conversation About Builder Incentives

- When to Take the Incentive—and When to Walk Away

- Specific Neighborhood Considerations (Taxes, HOA, and What to Watch)

- FAQs About Builder Incentives

- Action Steps if You’re Serious About Using Builder Incentives

- Final Thoughts — My Honest Opinion on Builder Incentives

- Want Help Evaluating a Builder Incentive Near You?

Why Builders Are Handing Out Cash (or Low Rates)

First: builders are not charities. When you see builder incentives like cash at closing or low rate promos, the simple truth is that builders want to move product. Inventory sitting unsold costs them money—interest on loans, carrying costs, taxes, and lost momentum—so in a slower market they’ll use incentives to speed sales.

There are a few big reasons builders offer incentives right now:

- They want to reduce inventory and hit sales goals.

- Higher market mortgage rates cut buyer purchasing power; offering a buy-down or rate pool restores affordability.

- It’s marketing gold—simple messaging like “4.99% fixed” drives internet leads.

- Some builders have lender partners who can pool rate buys, enabling temporary lower rates.

So yes— builder incentives are real, and they’re effective. But real and good value are not always the same. That’s what we’ll unpack next.

Common Types of Builder Incentives (and How They Work)

When you scroll builder websites or their Facebook ads you’ll typically see a handful of incentive types. I’ll list them, explain the mechanics, and give my gut reaction.

1) Interest rate buy-downs (temporary or multi-year)

This is a very common builder incentive right now: builder (or its lender partner) pays to lower your note rate for the first 1–3 years, then the rate adjusts to a higher fixed number for the remainder. Examples I see:

- “2.99% year 1, 3.99% year 2, 4.99% year 3+” (a 2-3-1 buy-down)

- “4.99% fixed for life” if the builder has secured a pool of money at a lower rate

- “4.99% year 1, 5.99% thereafter” (a 10-point buy-down then lender rate)

Why I like them: they directly lower your monthly payment in the earliest months when affordability is tight. If your budget is hovering around a threshold, a rate buy-down can be the difference between qualifying and not qualifying.

What to watch for: almost always these require using the builder’s preferred lender to qualify for the promo. Also, buy-downs often exclude additional closing help—so you might not get both the rate and big closing cost credit at the same time.

2) Closing cost credits or “pick your savings” buckets

Some builders offer a lump-sum credit to be used for closing costs, rate buydown, or design center options. You’ll see language like “$20,000 in closing costs” or “Save up to $35,000 your way.” Those are builder incentives that let you decide the best use—close costs, upgrades, or a rate buy-down.

Why I like them: flexibility. If you want to minimize out-of-pocket cash at closing, use it for closing costs. If you’d rather lock a lower rate, use it toward a buy-down. My approach: structure the incentive around what gets you into the asset with the least cash out of pocket.

What to watch for: “up to” means top-end only applies in specific cases. Check the fine print and ask what maximum combinations are allowed.

3) Price reductions and design center allowances

Price drops (straight off the list price) or design center allowances (fixed dollars to spend on finishes) are classic builder incentives. Price reductions are transparent—lower purchase price means smaller mortgage and less taxes. Design allowances let you pick options without paying full freight.

Why I like them: price reductions are immediately tangible. They reduce monthly payments and taxes and are easy to calculate. Design allowances give buyers upgrades they might otherwise not afford.

What to watch for: sometimes allowances are a trap if the base price is inflated to compensate. Confirm the neighborhood comparable prices before assuming the discount is real.

4) Appliance packages and small add-ons (fridge, blinds, garage opener)

Builders will often list items like washer/dryer, fridge, window blinds, garage door opener. These are real but low-dollar. In isolation, these builder incentives are not game-changers.

Why I like them: they can be useful if you value a turnkey move-in. But don’t let a fridge sway you if the larger numbers don’t pencil out.

What to watch for: sometimes these are presented to distract from the fact that the major incentives are limited or require strict qualification.

Builder Examples—my Quick Reactions (What I Saw on Their Sites)

I went intentionally combing builder websites and reacted live. Here’s the short of what I saw and what I think—real talk, builder-by-builder.

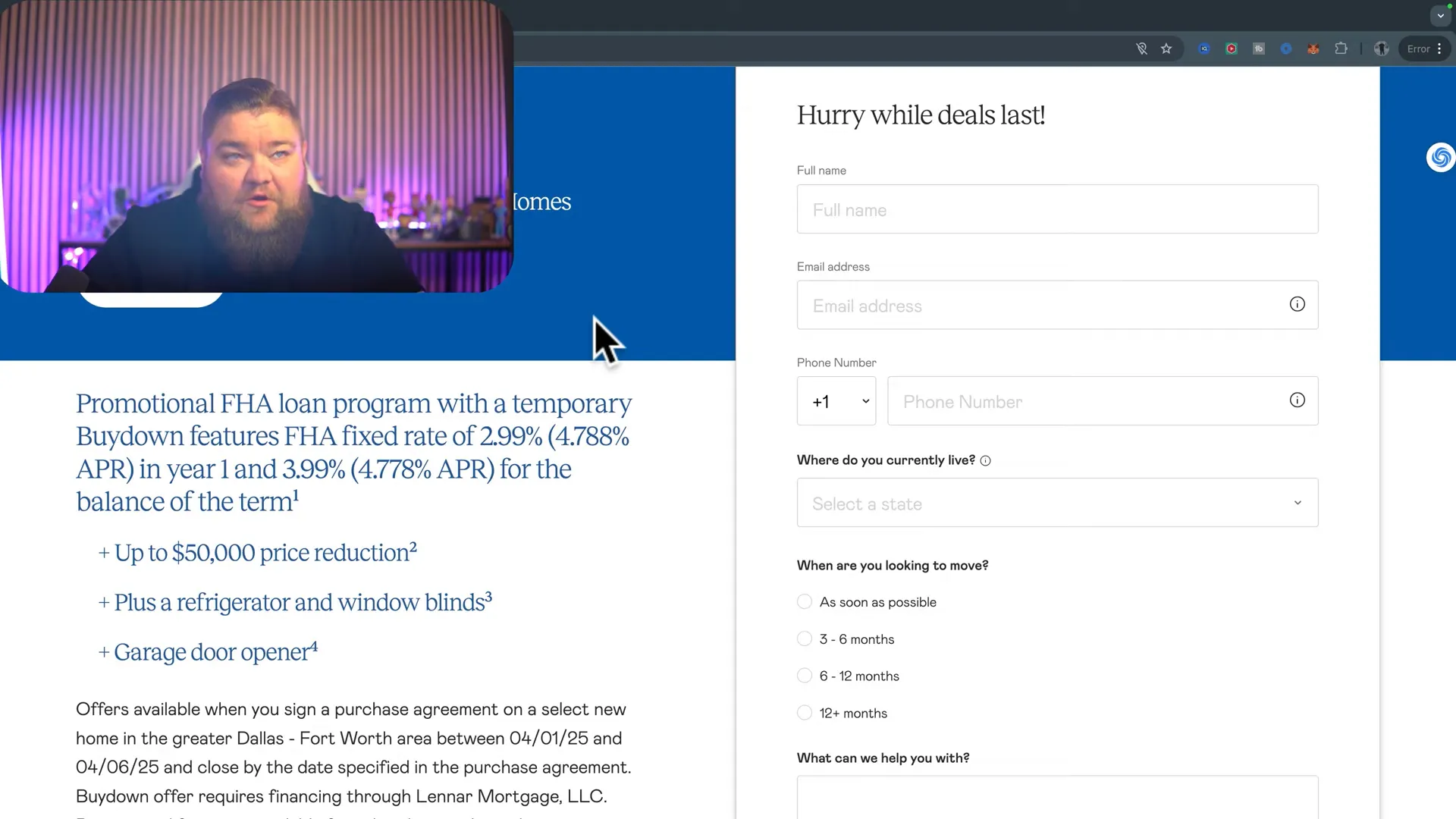

Lennar — My reaction: skip (in many cases)

Example: a flashy promo with a 2.99% year 1 then 3.99% thereafter, $50,000 price reduction, and minor add-ons. My reaction: that one felt like a mismatch. If the floorplan, price, or finish level doesn’t match your needs, you shouldn’t be swayed by a big headline number. I said in the video: “You couldn’t give me enough money to buy this house.”

Bottom line: not all builder incentives are equal. If the base product (size, layout, quality, neighborhood) is not what you want, don’t be seduced by a flashy promo.

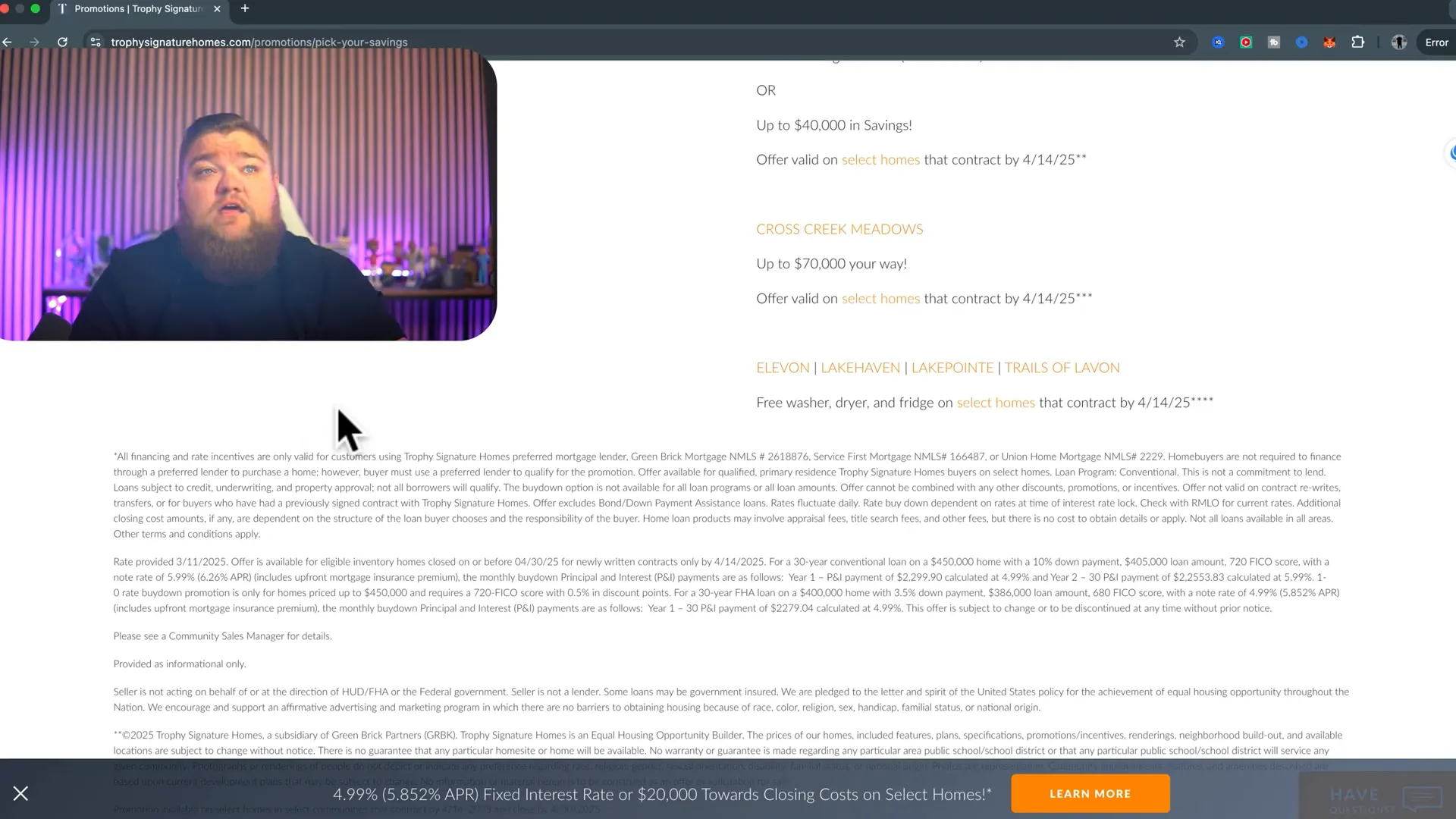

Trophy Homes — My reaction: a big yes for certain budgets

Trophy was advertising pick-your-savings: 4.99% fixed or $20,000 in closing costs and a refinance window. Their approach is clear and often well-executed: 4.99% OR closing help.

Why I like it: they consistently run these promos, and their inventory + land position means they can be aggressive. For many buyers under the $475k–$525k mark (my approximate sweet spot), Trophy offers real value via these builder incentives.

What to watch for: fine print. Most of these are valid only with the builder’s preferred lender and require credit- and down-payment thresholds. Read the terms: 720 FICO and 10% down as an example for some offers, or FHA at 3.5% and 680 FICO for other rate examples.

Meritage Homes — My reaction: solid contender

Meritage runs rolling 4.99% offers and occasionally pairs them with closing cost help. For buyers trying to get into the market and comparing Trophy vs. Meritage vs. others, I’d often pick Trophy or Meritage over some local, lower-quality options.

Meritage is consistent with their builder incentives and their product has a predictable quality level.

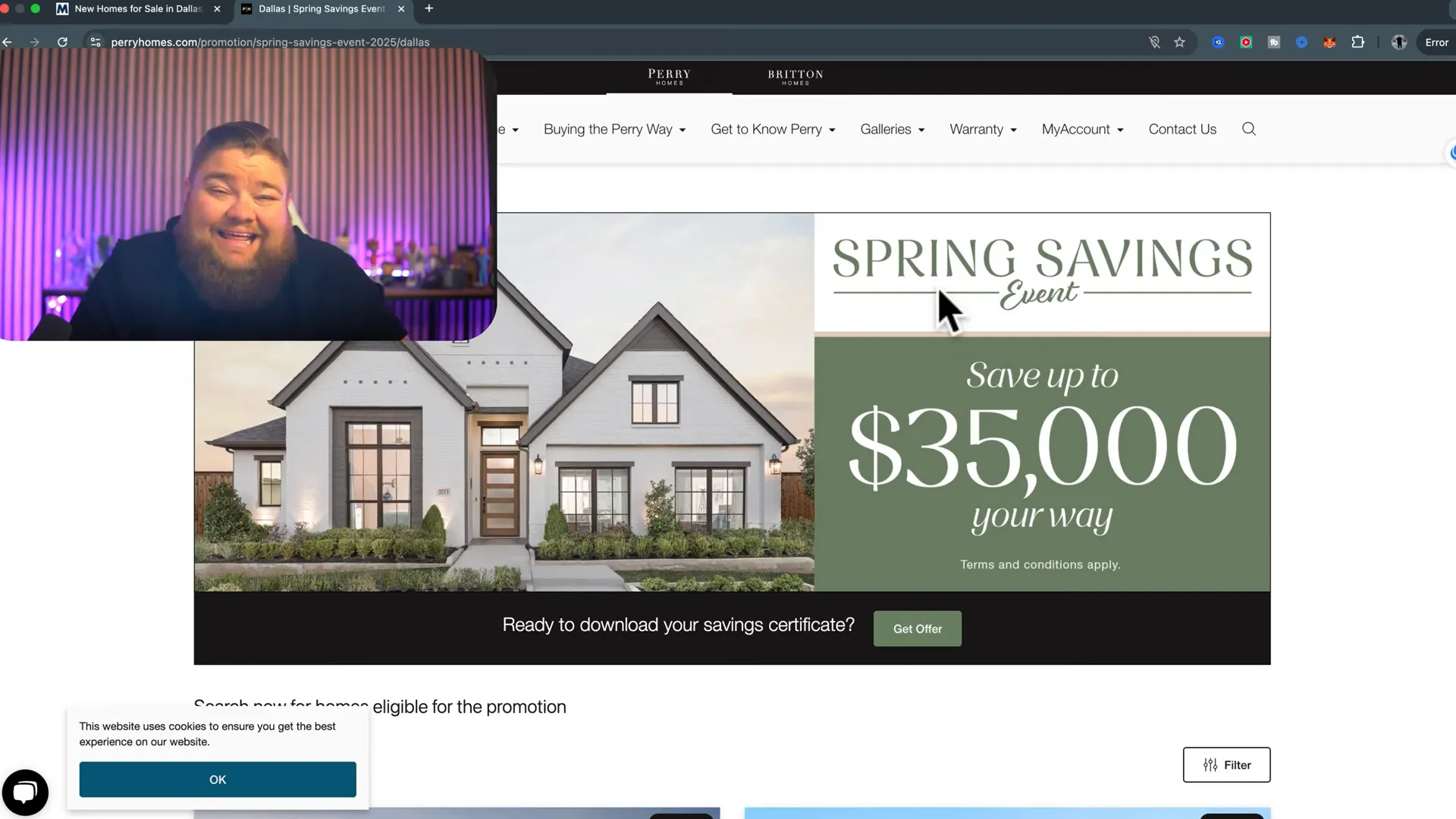

Perry Homes— My reaction: flexible and local

Perry had “Save up to $35,000 your way” promos. I like the flexibility here. If you want to decide whether to get a design center island or close with 100% cash, flexibility helps.

Again, check the fine print: “up to” matters, and sometimes lender incentives are bundled into that top number.

Bloomfield Homes— My reaction: quiet but high-quality

Bloomfield often doesn’t advertise broad incentives on their main site. That’s not a red flag—many builders prefer community-specific promotions handled by sales reps. I still like them as an option; sometimes the best incentives come through the negotiating process with the local rep, not on the homepage.

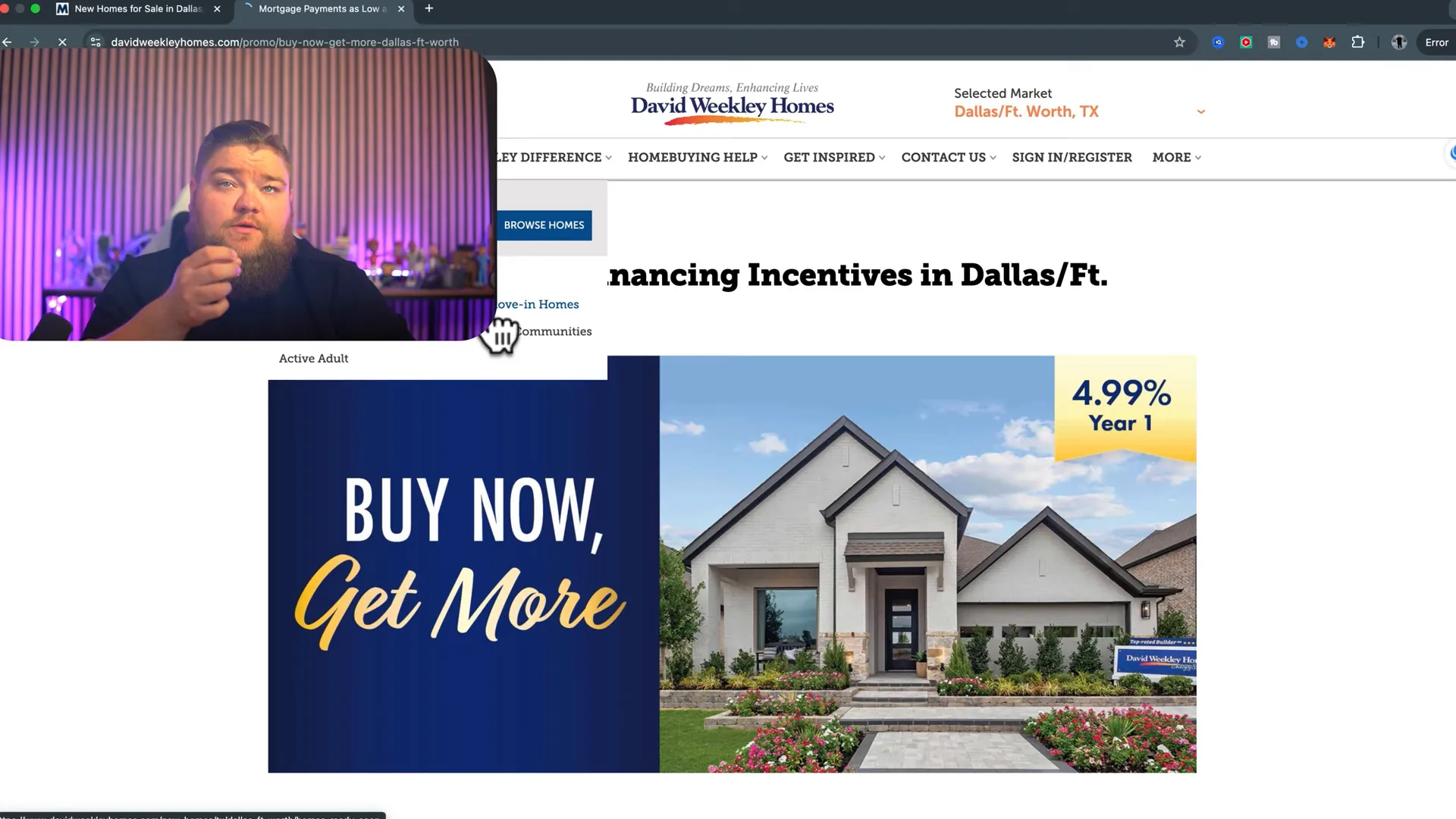

David Weekley Homes — My reaction: practical buy-down options

Some builders (I looked at one with a 4.99 year one scenario) run a 10-point buy-down plus another buy-down for the first 12 payments to lower monthly cost up front. That’s a clever way to make the move-in payment feel more comfortable.

Remember: the builder is often buying your rate down to a lower note rate for a period, which raises later payments. Make sure you can handle the future payment when the buy-down expires.

K. Hov / KHOV — My reaction: favorite so far

One of my favorites in the review was a 2.99 year one, 3.99 year two, and then locked at 4.99—this 2–3–1 buy-down followed by a 4.99 fixed rate is the sweet spot for a lot of buyers. Aggressive, clear, and impactful on monthly payments.

Heads up: you probably won’t get extra closing cost credits layered on top of a big buy-down. The builder is already spending a lot on the rate cut.

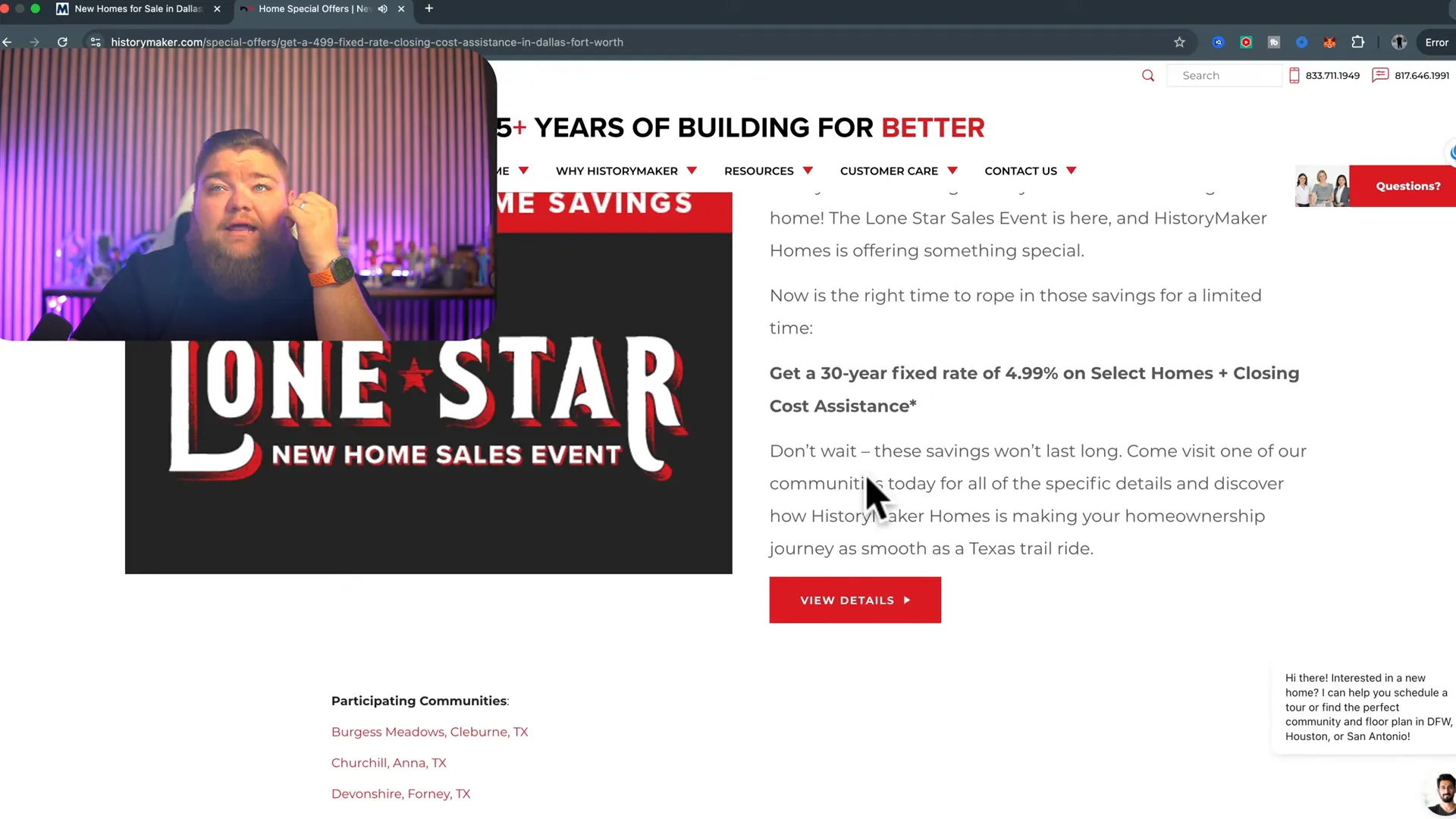

HistoryMaker and other production builders — My reaction: good for first-time buyers

Builders that focus on first-time buyers often give straightforward builder incentives like a 4.99% promo with modest closing cost help. If you want maximum square footage on a tight budget, those products can be the right fit—even if the finishes are simpler.

Highland Homes — My reaction: thoughtful and often reliable

Highland had a 4.99–5.49 rate pool with clear assumptions (example: 740 FICO and 20% down in their marketing numbers). They were transparent about how they secure lower-rate capital pools. That transparency is uncommon and valuable.

Real Payment Examples and Quick Math

I did a few rough examples in the video, and I’ll recap them here so you get the idea of how much difference a builder incentive can make. These are high-level, ballpark numbers—talk with a lender for exacts.

Example A — $375k home, FHA 3.5% down

Baseline market rate (hypothetical): 5.99% — estimated monthly mortgage (PITI) roughly $3,200.

Builder buy-down to 4.99% for year one: estimated monthly mortgage drops to around $3,000.

Result: immediate monthly relief of ~ $200 — enough to make the difference for many buyers who are right at their max qualifying payment.

Example B — $630k home with 2.99% first year

Large home example: builder offering 2.99% year one, 3.99 year two, 4.99 fixed after. On a $630k example, their marketing estimated payments around $4,000/month — the math was close.

Be realistic: aggressive buydowns will lower early payments a lot, but you must be prepared when the rate increases. If you expect your income to grow, or plan a refinance within the builder’s refinance window, this path is viable.

Fine Print That Matters—what I Always Check

There are recurring clauses and details in builder incentives that can change whether the deal is great or mediocre. Here’s my checklist I go through with clients every time:

- Preferred lender requirement: Most incentives require you to use the builder’s lender. You can buy the home without them, but the promo usually requires it.

- Qualifying thresholds: Look for assumed credit score (e.g., 720 or 740) and down payment (3.5% FHA, 5% conventional, 10% in some illustrations).

- Contract & close dates: Many offers apply only to contracts written and homes closed by specific dates.

- Inventory vs. new build: Some promos only apply to quick-move-in inventory homes, not to-to-be-built or custom build lots.

- Stackability: Can you combine rate buys with closing cost credits? Often not. Ask before you assume.

- Post-buydown payment shock: What will your payment be when the buydown ends? Model that number and be sure you can afford it.

- Tax and HOA impacts: Builder marketing numbers sometimes exclude property taxes and HOA dues—those will change monthly payment significantly.

How I Approach a Buyer Conversation About Builder Incentives

My job is to help buyers control the asset for as little out-of-pocket as possible while maximizing long-term value. When a client asks about builder incentives, I follow a process:

- Ask the budget, must-have neighborhoods, and timeline.

- Identify which builders and communities fit the budget and lifestyle.

- Run realistic net-payment numbers with taxes and HOA included—both with the incentive and without it.

- Compare a simple price reduction vs. a rate buydown vs. closing cost credit—whichever gets the buyer into the home with the best long-term outcome.

- Confirm eligibility (credit score, down payment, borrower type primary residence only, etc.).

- Discuss refinance plans if the incentive includes a refinance window: how soon would we realistically refi? What are the costs?

If you’re comparing offers—don’t just look at the headline “4.99%” or “$20,000.” Dig into the numbers. The way the builder structures the builder incentives can change which option is best for you.

When to Take the Incentive—and When to Walk Away

Take the incentive when:

- You love the product, location, and quality of the builder—this is important. Good incentives don’t fix a bad floorplan.

- The incentive measurably reduces your monthly payment now or over the life of the loan and the fine print doesn’t introduce unacceptable risk.

- You have a realistic plan for the payment increase when a buydown ends (salary growth, refinance plan, or other).

- The builder’s lender terms look reasonable (no outrageous lender fees to recoup the buy-down).

Walk away when:

- The product is not what you want but the promo makes you feel pressured to buy.

- The fine print requires unrealistic credit or down payment thresholds that you don’t meet.

- The builder’s base price looks inflated and the “discount” is just marketing smoke.

- Lender fees or prepayment penalties erase the value of the incentive.

Specific Neighborhood Considerations (Taxes, HOA, and What to Watch)

A headline rate or credit does not change property taxes or HOA dues. Two things I drill into because clients underestimate them:

- Property tax rates: In North Texas, tax rates vary a lot. I called out Rockwall repeatedly because some neighborhoods there have lower tax rates (~1.56% in my example), which materially helps monthly costs even when home prices are higher.

- HOA dues and lot size: A cheaper rate in a community with a large HOA fee might not actually save you money month-to-month.

Always include taxes and HOA in your PITI calculation when weighing builder incentives.

FAQs About Builder Incentives

Are builder incentives legitimate or are they misleading?

Most are legitimate. Builders and their preferred lenders can and do secure blocks of lower-rate capital or budget to offer closing credits. The advertising is real, but the offer often has qualifying rules—preferred lender requirement, credit score, down payment, and specific contract/close windows.

Do I have to use the builder’s preferred lender to get the incentive?

Usually yes, for the promotional incentive. You can still buy a home without their lender, but to capture the advertised builder incentives you’ll typically need to use the preferred lender.

Should I pick a rate buy-down or cash at closing?

It depends on your goals. Rate buy-downs reduce monthly payments early (good if you need immediate affordability or expect income growth). Cash at closing reduces your out-of-pocket closing costs or can fund upgrades. Run the numbers to see which gives better net benefit over your expected ownership timeframe.

How long will builders keep offering these promotions?

No one knows. They’re market-driven. When inventory increases or mortgage rates drop materially, these promotions will scale back. Right now (this season) builders are aggressive; that could shift quickly.

Can incentives be combined?

Sometimes, but often not. Read the fine print. “Pick your savings” prompts usually allow selection of two perks, but “up to” language is common. Ask sales reps directly and get written confirmation.

Action Steps if You’re Serious About Using Builder Incentives

- List your non-negotiables: neighborhoods, schools, commute, must-have features.

- Decide your budget and run PITI inclusive of taxes and HOA.

- Contact a local agent who knows new construction and the builder reps (hello, that’s what I do).

- Get prequalified with the builder’s preferred lender to see which promos you actually qualify for.

- Request written confirmation of the incentive terms and what is excluded.

- Model future payments when buy-downs expire and verify you can afford that payment or have a plan to refinance.

Final Thoughts — My Honest Opinion on Builder Incentives

Bottom line: builder incentives are not a scam. They’re a tool builders use to sell homes in a tough interest-rate environment. Some offers are truly helpful and well-structured; others are marketing noise attached to products I wouldn’t recommend. My job is to help buyers sort the wheat from the chaff.

If you love the builder’s floorplan, the neighborhood fits your needs, and the incentive materially improves your monthly situation or reduces your out-of-pocket cost, then yes—take the deal. If you’re being pushed into a product you don’t like just because the headline looks shiny, step back and run the numbers.

Remember: you control the asset. Use builder incentives to minimize cash outlay and maximize long-term value, not to chase marketing headlines.

Want Help Evaluating a Builder Incentive Near You?

If you’re looking at a builder’s promo and want an honest breakdown—send me the link, the fine print, and I’ll walk you through the math, the pitfalls, and whether it’s a true win for you. I work with buyers across DFW on new construction every day and I’ll explain which incentives I recommend and why. Thinking about buying a home? Call or text me at 469-707-9077 and I’ll make sure you get the right deal—not just the flashy promo.

Zak Schmidt

From in-depth property tours and builder reviews to practical how-to guides and community insights, I make navigating the real estate process easy and enjoyable.